Introduction to Blackstone and BlackRock

In the fast-paced world of finance, two names consistently rise above the rest: Blackstone and BlackRock. These titans have carved out their niches in asset management, investment strategies, and financial services. But what sets them apart? As both companies wield significant influence over global markets, understanding their differences is crucial for investors and industry enthusiasts alike. Whether you’re a seasoned investor or just starting to explore the finance sector, this exploration into “Blackstone vs BlackRock” promises insights that can help you navigate today’s complex financial landscape. Buckle up as we dive deep into the captivating rivalry between these giants!

History and background of both companies

Blackstone vs blackrockwas founded in 1985 by Stephen Schwarzman and Peter Peterson. Initially, it focused on mergers and acquisitions advisory services. Over the years, Blackstone evolved into one of the largest investment firms globally, specializing in private equity, real estate, and credit.

BlackRock began its journey in 1988 as a risk management firm. It originally served institutional clients with innovative portfolio strategies. As demand grew for asset management solutions, BlackRock expanded rapidly. By offering exchange-traded funds (ETFs) through its iShares brand, it became a key player in investment management.

Both companies have distinct origins but share a common goal: to provide unparalleled financial services. Their different paths illustrate how varied approaches can lead to success within the financial sector.

Comparison of assets under management

When comparing Blackstone and BlackRock, assets under management (AUM) serve as a significant metric.

Blackstone vs blackrock stands tall with approximately $10 trillion in AUM, making it the largest asset manager globally. Its diverse portfolio includes everything from ETFs to mutual funds, catering to a wide range of investors.

In contrast, Blackstone focuses primarily on alternative investments. With around $975 billion in AUM, its strategy centers on private equity and real estate. This specialization allows for higher returns but comes with different risk profiles.

The difference in scale between these two giants reflects their business models. While both companies excel in their domains, the sheer volume at which BlackRock operates dominates traditional asset management discussions.

Investors often weigh these figures carefully when deciding where to allocate resources or seek advice from financial professionals. Each firm has carved out its niche within the financial landscape, showcasing unique strengths tailored to varying investor needs.

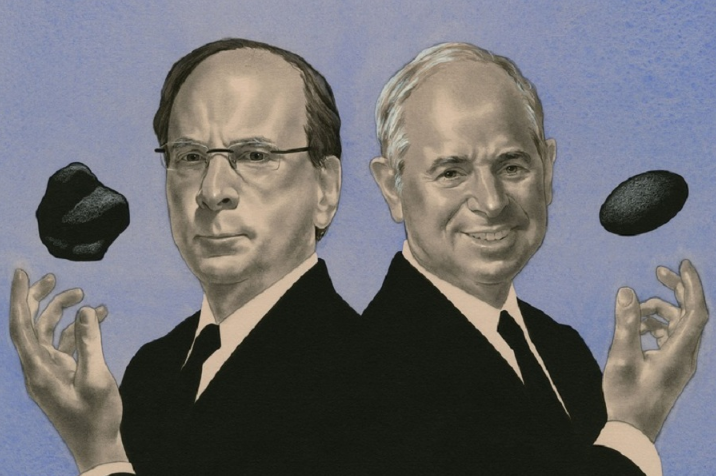

Key players and leaders in each company

Blackstone and BlackRock both boast influential leaders who shape their respective strategies.

At Blackstone, Stephen Schwarzman stands out as the co-founder and CEO. His vision has propelled the firm to become a global powerhouse in private equity, real estate, and alternative investments. Under his leadership, Blackstone has consistently sought innovative ways to drive growth.

On the other hand, Larry Fink leads BlackRock as its co-founder and CEO. Renowned for his insights into market trends, Fink emphasizes technology’s role in asset management. His advocacy for sustainable investing also positions BlackRock at the forefront of responsible finance.

Both leaders are instrumental in navigating complex financial landscapes while adapting to evolving market demands. Their distinct approaches reflect each company’s core mission but resonate with investors seeking stability and growth amidst uncertainty.

Services and products offered by Blackstone and BlackRock

Blackstone vs BlackRock both offer a diverse range of financial services tailored to various client needs.

Blackstone primarily focuses on private equity, real estate investments, and credit markets. Their expertise in alternative assets has positioned them as a leader in asset management. With an extensive portfolio that includes infrastructure projects and hedge funds, they cater to institutional investors seeking high returns.

On the other hand, BlackRock excels in index fund management and exchange-traded funds (ETFs). They provide comprehensive risk management solutions through their Aladdin platform. This innovative technology helps clients navigate complex investment landscapes effectively.

Both firms aim to serve institutional clients but with distinct approaches. While Blackstone leans towards active management strategies, Blackstone vs blackrock emphasizes passive investing through its vast array of ETFs. Each company’s offerings reflect their unique perspectives on market opportunities and client demands.

Performance and success factors for both companies

Blackstone and BlackRock have carved distinct paths to success within the financial landscape. Blackstone, primarily known for its private equity investments, thrives on strategic acquisitions and a hands-on management style. Its ability to identify undervalued assets has been crucial in driving high returns.

On the other hand, BlackRock stands out with its dominance in investment management through innovative technology solutions. The firm excels at utilizing data analytics to optimize portfolio performance. This tech-driven approach gives it an edge in understanding market trends and client needs.

Both companies benefit from strong leadership that emphasizes adaptability. They respond swiftly to changing economic conditions, ensuring longevity amid volatility. Their diverse services also contribute significantly; while Blackstone focuses on real estate and credit strategies, BlackRock’s extensive range of ETFs attracts a broad investor base.

This complementary yet competitive dynamic shapes their respective positions in the ever-evolving financial sector.

Impact on the financial sector

Blackstone and BlackRock have profoundly influenced the financial sector. Their massive scale drives innovation, shaping industry standards. Both firms push boundaries in investment strategies, encouraging competition among peers.

As leaders in private equity and asset management respectively, they set benchmarks for performance metrics. Investors often look to them as examples of effective risk management and portfolio diversification.

The impact extends beyond their balance sheets. Blackstone’s real estate ventures have transformed urban landscapes, while BlackRock’s technology-driven solutions are reshaping how clients engage with investments.

Their presence also invites regulatory scrutiny, prompting discussions on market stability and ethical investing practices. This dynamic fosters a more transparent environment across the finance landscape.

With each strategic move they make, these giants not only influence market trends but also inspire smaller firms to innovate further—creating a ripple effect throughout the sector that can redefine traditional investment paradigms.

Analysis of recent news and developments for both companies

Recently, Blackstone has focused on expanding its real estate portfolio. The firm announced significant investments in logistics and residential properties across key markets. This move aims to capitalize on the growing demand for housing and e-commerce fulfillment centers.

Meanwhile, BlackRock has been making headlines with its aggressive push into sustainable investing. The company launched new funds that prioritize ESG (environmental, social, governance) criteria. This strategy highlights a shift in investor preferences toward ethically responsible options.

Both firms are also adapting to changing regulatory environments. New policies around transparency and risk management are prompting updates in their operational strategies.

Moreover, tech innovation is playing a pivotal role for both companies. Blackstone is leveraging data analytics for investment decisions while BlackRock enhances its Aladdin platform to improve client services and asset management capabilities.

Future predictions for Blackstone and BlackRock

The future looks promising for both Blackstone and BlackRock, albeit in different ways. As the demand for alternative investments continues to surge, Blackstone is well-positioned to capitalize on this trend. With its extensive portfolio in private equity and real estate, it may see substantial growth.

On the other hand, BlackRock’s dominance in technology-driven investment solutions suggests a bright path ahead. Its focus on ESG (Environmental, Social, Governance) investing aligns with shifting market preferences toward sustainability.

Both firms are likely to innovate further as they adapt to changing regulatory landscapes and investor needs. Strategic partnerships could play a vital role in their expansion efforts.

As competition intensifies within the financial sector, agility will be key for both companies. Their ability to pivot quickly will determine who emerges as the leader moving forward. The landscape is evolving fast; keeping an eye on these players will reveal exciting developments ahead.

Conclusion:

When comparing Blackstone vs BlackRock, it’s evident that both companies have made significant impacts on the financial sector. Their histories reveal a fascinating evolution from their inception to their current status as giants in asset management.

Blackstone has carved out a niche in private equity and real estate investments, while BlackRock has become synonymous with index funds and ETFs. The assets under management for both firms are staggering, showcasing their ability to attract capital from global investors.

Leadership plays a crucial role here too. Each company boasts experienced executives who steer strategy and operations toward growth. They offer diverse services tailored to various market needs—whether it’s alternative investments or risk management solutions.

Performance metrics often tell different stories depending on the focus area one examines. Both firms have unique strengths that contribute to their ongoing success within an ever-changing landscape.

Recent developments highlight how each firm is adapting to new market trends and technologies. This adaptability is vital for maintaining relevance in today’s fast-paced world of finance.

Looking ahead, predictions about these titans suggest continued innovation and expansion into emerging markets will be key themes driving future performance.

The rivalry between Blackstone and BlackRock is more than just numbers; it reflects broader trends influencing the financial industry at large, making this comparison a critical topic for investors seeking insights into where they might place their trust—and money—in the years to come.